Today I want to take a look at some criticisms of Demand Studios other than the low rate argument. And I'm going to give you facts -- lots of them -- so you can make your own decisions about some of these issues and whether or not writing for Demand Studios is a smart move in your situation.

So today I want to follow up on Carson Brackney's recent post on Demand Studios where he mentioned that he's giving Demand Studios a go for himself so he can form firsthand opinions (which is something I respect by the way). I did have a wee issue with one thing though -- his mention of the DS debate, and the focus on criticism revolving around rates they pay writers.

Rates are Just the Tip of the Iceberg

Yes, it's true that many people have criticized the $15 rates for much of their content and even some of their higher rates. On one level I agree with those people. On another level I really don't give a damn. Why? Because I know the writers who want more, who are worth more, and who are willing to work for more will get much more in their freelance writing careers.

As for those who are happy with Demand Studios? Good for them -- I'm genuinely glad they're happy, and as I (and other writers) have said repeatedly there's a place for content mills for some writers. And those who want more but who don't want to work for it or who are too busy making excuses to try? Well, then they're probably right where they deserve to be right now in their careers, and hopefully they'll take steps to improve their situation in the future.

But here's the thing. You can't really have an honest conversation about the Demand Studios / Demand Media supporters and opposition unless you go beyond the rates. That's far from the only criticism out there, and I think many are valid. Personally, my biggest issues with DS include the occasional misleading marketing they engage in to try to solicit writers, the frequency at which they contradict themselves, and what appears to be special treatment from Google (although that's an issue we'll discuss far more thoroughly at a later time, and it's more an issue with Google than Demand Studios itself). For now let's get back to the issue of "bias."

More About Bias (Mine and Theirs)

(Note: I really can't stand the whole "martyr" card some bloggers like to play with their readers. So let me apologize up front, because I know this next segment might sound that way.)

As much as (coming from a PR background) I hate the buzzword, I still am a big supporter of transparency. So I think it's only fair that I explain my background in this topic area so you know where I'm coming from, where my insight is based, and why this issue is something I'm so passionate about. And even though my past with these sites is already publicly well-documented, I'd rather refresh you on that than have someone come crying later saying "how can you speak out against mills when you write / wrote for them?" I don't write for them. So let's be clear on that up front (since someone asked me that on Twitter the other day). But I used to.

I have a lot of experience with content mills, content farms, content networks, or whatever you'd like to call them. There were positive elements. There were plenty of negative ones.

I've worked for these sites as a writer. I've worked as an editor. I used to be one of the most outspoken supporters of one in particular -- Suite101. I've tested others for the benefit of my readers here, including Associated Content and the article marketing site EzineArticles.com. I've been around. And since then, Yo has picked up on that testing with other mills and networks here on the blog. But back to our flashback....

Not long after leaving About.com, I was hired by Suite101's new management team / owners as their Technology Editor. Around the same time I was also writing for a network (now gone I believe) called All Info About -- their model was a bit different (they put an ad on your site in their network, but you could also place your own to directly earn income, so there really wasn't any guesswork involved).

I try not to judge single sites based on the whole lot. That would be silly. My opinions were, and are, formed individually. Had I judged them based on issues with others, I never would have given Suite101 a try after the editor overturn drama with About.com at the time. But Suite101's editor-in-chief (no longer there from the last info I heard) convinced me that they were different; that they really cared about the writers. And even though there had been a bad history under the old owners before them, I think they really did have decent intentions in the beginning. They did actually listen to the editors and writers. Unfortunately things got to a point where I felt that changed.

So not only am I well aware of all of the arguments for content mill writing, but I used to wholeheartedly believe them. I know what it's like to feel passionate about them, and to get really angry when people bash them. So as much as that can drive me crazy today when people take general comments personally, I do understand what they're feeling. The difference is that I was there on the backend long enough that I finally woke up. In the end, it's about money -- the big content sites want to make it, and they make it by paying you far less than you could be earning by pursuing gigs elsewhere. They appeal to the lowest common denominator (which is reflected in every single one of us sometimes) -- what's "easy" starts to look like what's best for us.

What really bothers me isn't that I used to very aggressively support content mills and speak out in their defense. It's that I convinced other writers like you to believe that. It was my job to tell you the regular gig made it worth it. It was my job to tell you residuals were better than a much higher up front payment (that could have paid down your high interest bills or gone into savings and investments to earn interest for you rather than for the content site). It was my job to tell you that working for a content site was an amazing thing you could do for exposure (with no regard for the fact that there were better things you could do for exposure while earning far better money, even as a beginner). And I did my job. And as I've said in posts here before, I'm still ashamed of that fact.

I'm ashamed because I've always cared about the writing community in general. And I should have known better. I should have crunched the numbers sooner. I should have stopped thinking of it in terms of what it could be, and instead seen it for what it really was. Even while recruiting writers (many of whom I'm happy to say left with me or shortly after me, and several of whom I'm still quite friendly with), I did what I could to help them earn more. I volunteered a lot of my own time to teach a select group of Suite101 writers about Internet marketing and SEO -- things to help them promote their sites and increase their earnings. But it wasn't enough.

And that's why I'll always try to do more here at All Freelance Writing to help writers realize their options before they end up in the mill rut. It's why they'll never be promoted here as a great option for writers, even though I (and other contributers) have tried to treat them fairly in that we've generally acknowledged their place for some. But we don't write for hobbyists here. We write for freelancers who are looking to build professional careers.

That is the context in which you should take the rest of this post.

And keep something else in mind. There's very little in it for me to write this post. We've seen tremendous traffic growth without it, and no amount of traffic or links will make giving up nearly all of my free time for two days, plus extra hours up late each of those days worth it -- I value my time too much, and if you've been a regular reader here for a while, you already know that.

I get nothing out of telling other writers they can do better. If anything, I increase the competition within my own target market. In fact, I've recently been coaching a Demand Studios writer, bringing her not only into my target market but right into my own personal client base. It's not about me. It's not about this site. I only get this worked up over an issue if I truly believe in it. And I believe Demand Studios is a bad thing for most freelance writers trying to build serious careers.

Now ask yourself -- what's in for them when they spin things, give multiple versions of a story, and post misleading marketing copy to add more writers to their ranks? How about those $200 million in sales (and more expected this year)? I don't think there's anything wrong with wanting to earn money. That's just business. But I don't care about Demand Studios' business. I care about the writers who build the backbone of that business. You can believe what you want. You certainly don't have to agree with me on every point. You don't have to agree with me at all. At the end of the day, your decision to work for Demand Media Studios doesn't affect me.

When it comes to Demand Studios, I've talked to a lot of their writers (I've even hired some). I've read and listened to the executive interviews. I've heard both sides of the debate. I've read as much of their guidelines and other documentation as I could before forming opinions (some of which is linked and cited here). I've done my research. And now I've gathered a large collection of sources for you, not necessarily to convince you to think just like I do, but to cut through some of the PR speak and show you not what the critics are saying, but what Demand Media representatives actually have to say when you take the time to really look.

Remember, bias isn't just having an opinion and sharing it. Every time one of their reps gives an interview, it's biased in their favor. Every time someone they sponsor endorses them or features them, it's biased in their favor. Yet they criticize the critics, call us biased as though they're not when they're being employed by or otherwise paid by Demand Studios, and treat us as though having an opinion means we're not worth considering. Demand's CEO has even said that people who criticize Demand Studios just don't understand them.

And to that I say, "Oh really?" Their model isn't exactly rocket science. SEOs have been doing the same thing for years. The primary difference? They implemented algorithms to automate the keyword and ad spend research to make their process more efficient. They pay little per piece, so they can earn significant profits.

Look, it's one thing to change your mind about an issue. I've certainly done it (as detailed above). I'm not one who tries to hide their past views by deleting blog posts or comments. That wouldn't be fair to my readers, and it wouldn't be fair to me. Everyone is allowed to learn and grow -- two things I hope I never stop doing. But what you'll see below doesn't look to me like a case of someone changing their mind when you look at the dates and the actual information coming from these Demand Studios reps.

Then again, maybe I'm wrong. Maybe we all are just ignorant when it comes to Demand Media. After all, their own people can't seem to get their story straight, so who could blame the laymen like us for not understanding the full picture.

Let me give you a few examples -- here are some of Demand Media's / Demand Studio's claims, with a few follow-up facts for good measure.

Claim: Demand Studios Isn't Journalism (or Trying to be)

A big criticism of Demand Studios comes from those who worry the site and company will have a negative impact on journalism, on top of that industry's existing problems. There have been multiple instances where Demand Media's CEO Richard Rosenblatt has tried to say they're not targeting journalism, aren't participating in journalism, or are not creating news. At the same time, they've been seen advertising specifically targeting journalists. I think Rosenblatt sums it up nicely:

"Only the journalists call us journalists."

- Richard Rosenblatt - CEO, Demand Media [WebProNews, March 18, 2010]

I beg to differ:

"We're basically service journalism."

- Steven Kydd, Executive Vice President [Keynote for International Symposium on Online Journalism - University of Texas at Austin, 2010]

"We knew the life of a piece of online content was indefinite, so we focused on creating evergreen, "news that you can use," quality content"

- Jeremy Reed - Senior VP of Content and Editorial for Demand Media [TheWMFreelanceConnection.com Interview - February 2010]

"We are primarily looking for people with solid researching and reporting skills, and ideal candidates have had their work published in print or online."

- Robyn Galbos - Director, Demand Studios [Interview with WOW! Women on Writing - April 8, 2010]

"What is wrong with coming up with a way for thousands of writers–who have been laid off, by the way, from news organizations–knowing exactly how much they make, selecting their own topics and publishing when they want?"

- Richard Rosenblatt, CEO of Demand Media [BusinessInsider.com - January 11, 2010]

"Service Journalism Openings"

- Job posting soliciting writers [ProBlogger.com]

"Minimum of 3 years as a Managing, Line, Features, Section or Associate Editor at a newspaper, magazine, book publisher or publication (Please do not apply if you have fewer than 3 years experience)"

- Required qualifications listed for DS Copy Editors in a job ad from the company [JournalismJobs.com - open job ad that expires June 28, 2010]

"Educational and/or professional background in writing, journalism, blogging, etc." and "Familiarity of writing in AP style preferred."

- Job ad from the company [JournalismJobs.com - open job ad that expires June 24, 2010]

"Experience writing about health-related topics in a medical or health magazine, newspaper, journal, blog or other health website"

- Job ad from the company, hiring medical / health writers [JournalismJobs.com - open job ad that expires June 21, 2010]

As you can see, not only have Demand Media / Demand Studios executives referred to DS as a form of journalism, contrary to Rosenblatt's comments, but they've also quite actively recruited those with a journalism background. I consider that misleading at best, and a downright lie at worst. But it makes for great spin when you're being interviewed and you want to discredit some of your naysayers.

Claim: Demand Studios Isn't Meant to be a Full-time Job

Another criticism of the company has to do with the idea of the sustainability of using DS as a full-time job as opposed to a more limited and / or temporary freelance writing gig. That's because of the potential to push writers and other producers to burn-out levels.

The point is this: when you pay people very little and you know they desperately need that money, you put them in a position where they have to work for you so often just to get by that there's no time left for them to target better markets and grow their careers.

Executive VP, Steven Kydd doesn't seem to agree with that concern, because he says Demand Studios isn't about creating full-time jobs:

"We're not trying to create full-time jobs."

- Steven Kydd, Executive VP [Keynote for International Symposium on Online Journalism - University of Texas at Austin - 2010]

I guess their motives differ from their marketing...

"Work as much as you want, from wherever you want. Fill gaps between full-time jobs or work with us full-time – our freelance jobs are as flexible as you need them to be."

- On DemandStudios.com [Homepage copy]

"Some filmmakers use Demand Studios to fill time between other gigs, while others focus on Demand Studios assignments as their full-time job. We welcome both types of filmmakers and everything in between."

- On DemandStudios.com [Page recruiting filmmakers]

... and their executive pitches:

"First, take the application process as seriously as you would for a full-time position."

- Robyn Galbos - Director, Demand Studios [Interview with WOW! Women on Writing - April 8, 2010]

"Many of our freelancers are happy making a full-time living off of Demand Media assignments – as we’ve removed the “hustle” from freelancing that allows them to focus on what they love to do and cut out all the hassle associated with pitching ideas, finding assignments, chasing down payments, lather, rinse and repeat."

- Jeremy Reed - Senior Vice President of Content and Editorial for Demand Media [ TheWMFreelanceConnection.com - February 15, 2010]

Maybe they didn't all get the memo.

Claim: "Group Health Insurance" (Various)

This was a prime example of Demand Media releasing misleading information to market their site to new writers. The basic claim? Eligible writers can get inexpensive group health insurance, just like a "real job."

On the surface, I know that sounds great, especially to writers who are out of work and in serious need of new insurance coverage. But not all of the information they provided was 100% true. I mean, all you have to do to see that is read the actual insurance documents they eventually provided. If we were talking about a traditional comprehensive insurance plan here (you know... the things employers usually pay into partially), I'd think it was a great option for those who truly had no other option. But that's not the case.

I'm not going to get into all of the specifics of why this is misleading, the issue of promoting it to sound like an actual insurance benefit versus what's more of a discount plan (if they technically offer "benefits" they risk contractors being re-classified as employees by the IRS), and what freelancers need to know and discuss with an insurance professional before even considering moving to Demand Studios' health plan -- our resident licensed insurance professional already did that. I want to focus on three of the most alluring aspects they promote to make it sound great to writers, and then I'll share what the health plan documents actually say.

The health plans have been promoted at times in a way that could make them sound to an average reader like they're a substitute for traditional health insurance or self-purchased individual plans. Considering how these plans sound could influence whether or not writers sign up and churn out 90 articles to become eligible, I think that's a problem. Here are two examples:

"By offering guaranteed access to health care benefits as well as twice weekly payment, we are lightening the burden and removing more of the risk for those who want to follow their passion."

- Steven Kydd, Executive Vice President of Demand Studios [Company-issued press release announcing health care benefits - October 21, 2009]

"You may be able to enroll in the plan after 90 days if a ‘qualifying event’ occurs (such as you or your spouse losing a job which provided health insurance)."

- Demand Studios Health Plan FAQs

And here's what the actual insurance document says:

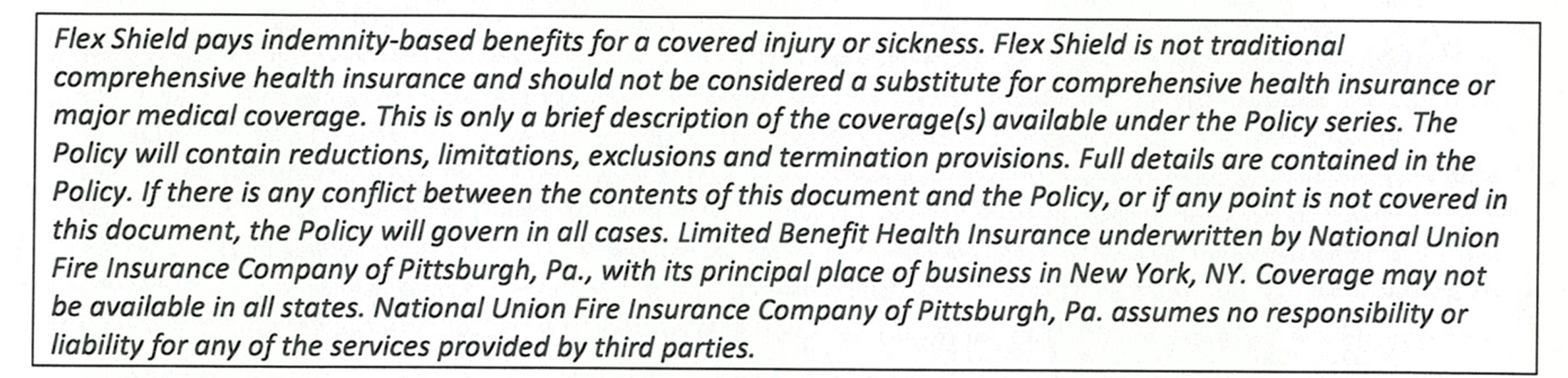

"Flex Shield pays indemnity-based benefits for a covered injury or sickness. Flex Shield is not traditional comprehensive health insurance and should not be considered a substitute for comprehensive health insurance or major medical coverage."

- Demand Media's Flex Shield Benefit Program Documentation [Page 2]

Here's what the on-site marketing pitch says about both deductibles and co-pays:

"No deductibles or co-pays"

- DemandStudios.com [Plan Highlights]

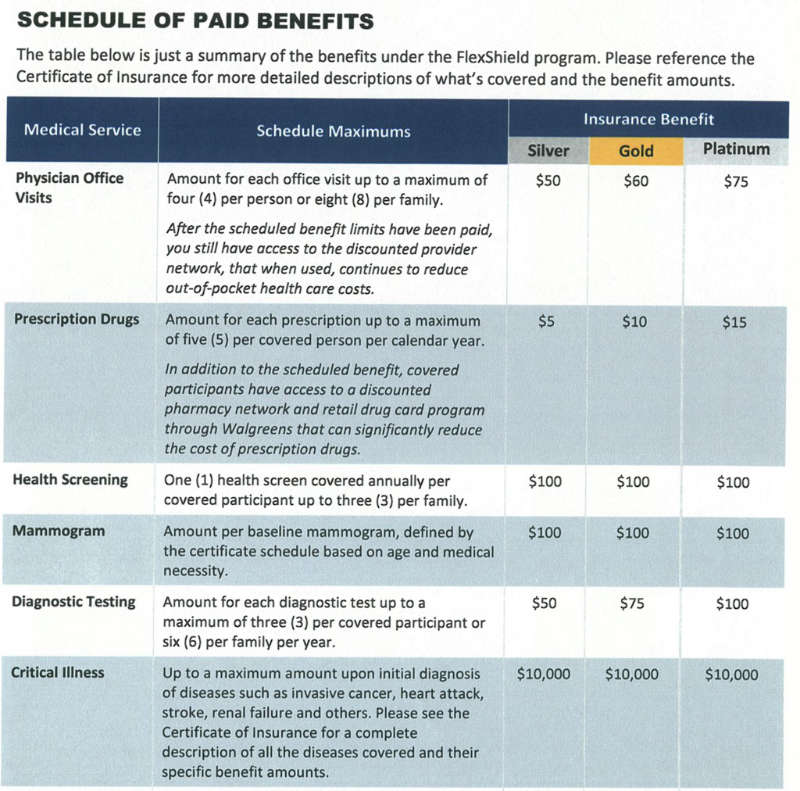

Sounds simple enough to me! Until you read the fine print. From a promotional perspective, this works, because to an average reader when you say something like "you don't have to pay any co-pays during your doctor visit, and you don't have to pay a deductible," it sounds like you're saying their monthly premium is all they have to pay. However, the plan is actually so limited in the amount of benefits paid, as well as the frequency at which benefits can be paid for certain things, that the person with the health plan actually can pay a lot out of pocket. Go ahead. Take a look at the fine print and coverage limits to see for yourself:

- Demand Media's Flex Shield Benefit Program Documentation [Page 7]

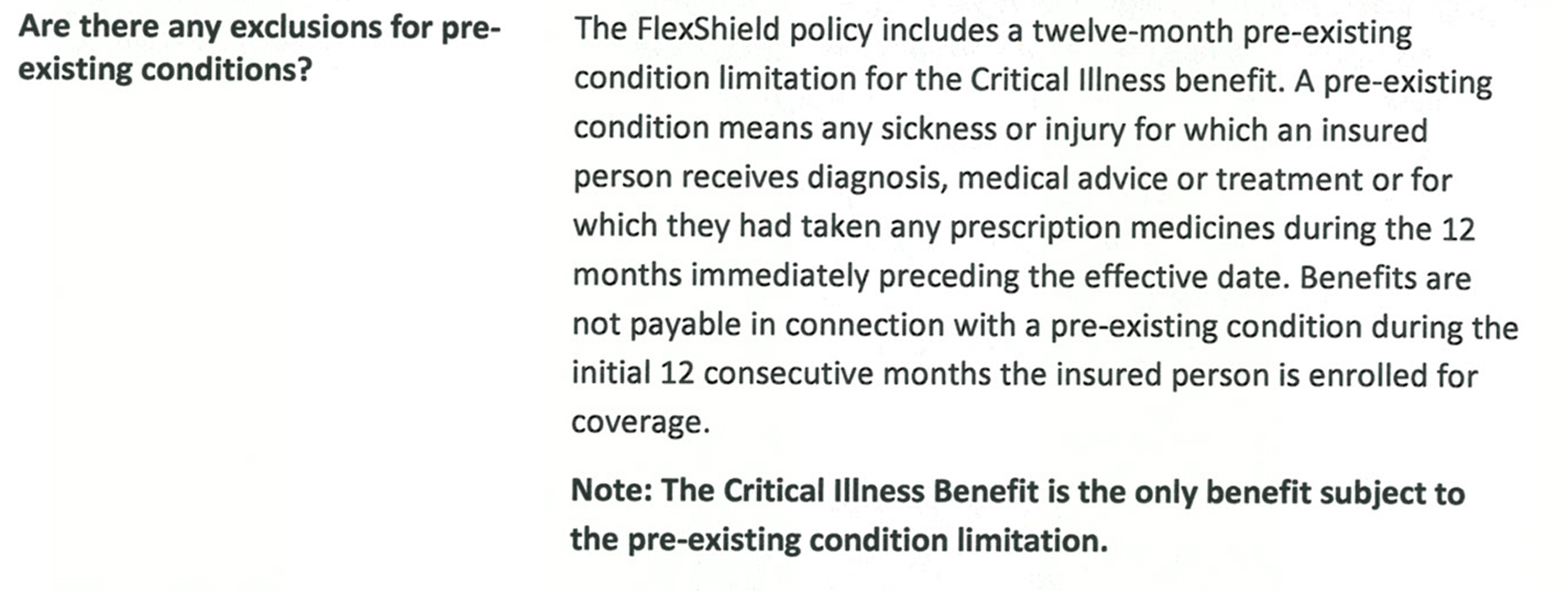

There's one more big "selling point" for the health care plan from Demand Studios that I take some serious issue with. It has to do with coverage for those with pre-existing conditions. Here's what they say in the marketing material on their website:

"Pre-existing conditions are covered. The only exception is if you know you are pregnant, you cannot join the plan for that purpose. (Other than in California where there is no such requirement)."

- DemandStudios.com [Plan Highlights]

Now if you read the documentation, you'll find that's just downright false. It's not the "only exception." There's another limitation involved with significant wait time before you'll get any kind of coverage for your condition. And if you have a serious health condition that's driving your decision to join Demand Studios in order to get this health plan, you might be in for an unpleasant surprise if you believe what they say on their site. Here's the actual exclusion language from the documentation itself:

Other Demand Studios Criticisms

I have page after page of additional research material here pointing to even more hypocrisy from Demand Media / Demand Studios. And they're behind other valid criticism of the sites. But given the length of this post already, I'm just going to summarize, as I think we tackled some of the biggest.

- Claims of an interest in quality content for readers and not just search engines - While on one hand Demand Studios wants writers to put together authoritative pieces, did you know they also have a resource blacklist that lists sites writers aren't allowed to use as sources? I'll give them some credit for blacklisting user-submitted and user-edited content like that from Wikipedia. I'll even give them credit for having a suggested reference list. But they also blacklist much more authoritative sites if they're competition in the search engines -- for example writers can't cite WebMD as a source if they write for Demand's Livestrong.com property. I don't know about you, but I'd call that a pretty clear-cut case of writing for search engines before readers.

- Claims that Demand content saves readers time -- This was one of the more laughable things I saw from Rosenblatt. He claimed that Demand Studios helps readers save time (among other things). Really? How is putting more content with the same information into search results helping people save time? If the information isn't there yet, then maybe. But that's not the case for the vast majority of their content I've come across. In those cases, at best they're taking the same amount of time to find the material. At worst they now have to sort through even more content to find the most reputable sources available. If you want to save me time with quality information (as opposed to just trying to rank in search engines for a variety of longtail search phrases for the same thing), then I shouldn't need more than one article from you on how to train a dog to sit. Instead, buy one high quality article covering a few different methods -- if quality and saving time are really your goals at least.

- Claims that Demand Studios is concerned with conflicts of interest -- Apparently that's only when it might be involved in their search engine rankings. On the other hand, they have no problem "sponsoring" others to write about them, as though that's not a similar conflict of interest affecting Web readers. I guess it just depends which side of the table you're on.

- Claims that Demand Studios improves people's lives -- Sure, I could see the occasional article "improving people's lives in big and small ways" if they're accurate, if there wasn't already more reputable information out there on the topic, etc. But before making claims quite that lofty, I do have to point out some gems of examples from their "contributing writers" (which, if I understand correctly are the ones producing through Demand, and going through their editorial process -- correct me if I'm wrong and I'll sincerely apologize). Do you know what their writers can teach you to improve your life? Here are a few examples: How to make yourself fart, How to have sex in order to get pregnant (apparently sexy lingerie will cure your baby-making woes -- although I didn't see their famous credible sources cited on that claim), and best of all How to pass a drug test for opiates. As for that last one, not only might they be helping people get away with breaking the law, but fact-check-fail: marijuana is not an opiate. I could have written a much better, much shorter article on that topic for them. Here it is: If you want to protect your "legal freedom and job eligibility" and you aren't using them out of medical necessity with medical supervision and documentation, don't use opiates you f*ing dipsh*ts! See? Now that's information designed to "improve people's lives."

- Claims that Demand Media pays writers on par with an average journalist's salary -- This one turned out to be much more than a "summary," but I think the numbers are important. While we won't get into the "is $15 per article fair?" here, there is one other issue regarding rates that I think is worth mentioning. It has to go to Demand's defenseof those rates.Not only did Rosenblatt claim people who criticized Demand just didn't understand them, but he also demonstrated that he doesn't understand the difference between independent contractors and salaried employees -- at least as far as pay being comparable goes. How? Well, in his manifesto he claimed "… we generally target an hourly rate for writers that is comparable to the average salary of a journalist."I wonder what journalists he's talking about. I mean, if you look at their various interviews and job ads you'll see quite a few average hourly pay estimates from folks at Demand -- $15-25 per hour, $22-25 per hour, $15-30+ per hour. Okay, so let's take that middle range and give them the benefit of the doubt and say the average pay is $25 per hour (remember -- we're talking about their typical writers, not an exception to the rule, no matter how happy you might be to be one).Now let's take a look at what journalists typically make. I can't even begin to guess where Rosenblatt got his average (even the government notes that salaries for these folks vary widely). Given that they produce such super-duper, source-cited, fact-checked content, let's give them the benefit of the doubt again and go with the information provided by one of their writers -- $22,000-50,000 per year (and here's the updated info from their source).Yikes. That's another big range, and that's only supposed to account for starting salaries (and not including journalists with advanced degrees, which their author notes should add another $10-20,000 to that starting salary). So let's pretend that Demand never looks for people with advanced degrees and doesn't want any actual "journalism" experience since that would mean a higher comparable salary they'd have to meet -- again, giving them the benefit of the doubt.

Let's assume not all DS writers are living in the lowest cost of living areas and go somewhere in the middle -- $30,000. So, for your basic $15 DS article, how many do you have to write in a year to earn a comparable "salary?" That's 2000 articles over the course of 52 weeks in a year; that comes to a requirement of writing 38.46 articles per week, or 7-8 articles every week day.

Could you write that many articles every single work day with no vacation time, sick time, holidays, personal days, etc.? (Keep in mind the DS job ads estimate an average of 30-60 minutes per article). But let's assume you can. Now let's also assume you're so good at what you do that you never get asked for an edit or a rewrite and you certainly never have an article rejected. You're also lightning fast at finding and claiming articles, dealing with editor communication, etc. to the point where we can pretend that time doesn't even exist. Cool.

You just might make Rosenblatt's point look legitimate. After all, if you plug in those same numbers for working days, number of weeks, etc. you'll find that poor little journalist only comes to around $14.42 per hour. Damn! Makes it look like DS writers live like kings, right? Well, yeah, when you twist stats to make it look that way, sure you can make it work. But here's the problem.

Freelance payments and the earnings of salaried employees are not directly comparable. For example, as a freelancer, you'll pay twice the Social Security and Medicare taxes as an employee (where the employer pays half). That puts you at 15.3% just for those taxes. Big difference.

You also technically do have business expenses, even if DS is your only paying client and you don't do any marketing -- at least a portion of your internet connection is a business expense, possibly a portion of rent and other utilities if you have a home office, etc. Now that might not sound like much to some, but there's even more to expenses.

To make freelance rates directly comparable to the earnings of an employee, you must compare those freelance earnings not to the employee's salary, but closer to the employee's total cost to their employer. In other words, all other things have to be equal. Unless Demand Studios is paying not just what that $30,000 per year journalist is earning as a salary, but also the value of any benefits (like health insurance, 401k contributions, sick time, vacation time, etc.) that the average employer is paying, the comparison is irrelevant because the salaried journalist is actually getting much more.

Remember, as a freelance writer, you're a business owner, and what you charge clients has to cover all of those things if you want to treat them as comparable. Salary.com does some nice breakdowns of this for you. So let's take a look at the difference in their base salary and actual cost when factoring in those benefits. Here's what we find:

Their U.S. national base pay is just over $31,000 (pretty close to what we estimated earlier). However, once you factor in average benefits, the journalist is actually getting the equivalent of a little over $47,000. Now what's the percentage increase? 51.6% That's pretty significant. That means you'd have to earn more than $45,000 per year working for Demand to really be paid on par with those salaried journalists with a $30,000 base salary (whose hourly "rate" now actually comes to around $21.63 per hour - again, big difference, but it falls within the general range Demand mentions). Okay. Let's crunch the numbers and see how it adds up.

To earn that $45,000 with Demand Studios, you have to write 3000 articles over the course of a year. That's 57.69 articles per week, or 11.54 articles per day on average. Then again, we focused on the journalist's real earnings specifically so you could account for things like time off (which you still pay for as a freelancer, just out of the rates you charge clients).

So in reality, you're probably not going to work 5 days a week, 52 weeks per year. Let's assume pretty modest vacation time, plus sick time, plus personal days, plus vacation days at four weeks off per year (off 20 working days). Now that comes to 12.5 articles per day, every week day left during the year. Based on Demand's estimates of 30-60 minutes per article for most of their writers (again, remember we're not talking about the exceptions, but the typical case study), that means you would have to write 6.25 - 12.5 hours every week day to actually make money comparable to the earnings of a starting journalist.

That still doesn't even account for your added taxes, and any business expenses you have that the employee-journalist does not. Nor does it account for any other time involved in working for Demand Media -- and let's be honest here, you're not perfect, and you're not robots. So sure, you could fudge the numbers to make them work by ignoring the business element of freelancing. And if you're willing to ignore that and are willing to work an average of over 9 hours per day, you might be able to say Demand Studios pays on par with an entry level journalism job.

But then again, when Demand Studios likes to tout their writers' experience, why should those more experienced writers consider that a point for Demand Studios? There's no logic to it. And keep in mind, that's not even on the upper end of the starting salary range. Not only that, but since Demand's CEO claims they're not journalists to begin with, why choose a starting journalist's salary as a base model, especially when journalists are commonly thought to be underpaid anyway? Again, there's no logic to it -- at least not if he's trying to make a case FOR writing for Demand Studios. And really, the math is moot anyway. Remember, Rosenblatt didn't say they pay on par with the typical salary for a brand-spanking new journalist. Just the average salary of journalists in general.

And that's all to say nothing of the general Google partner issues, the sleazy SEO keyword-stuffed links at the bottom of the DS site, the issues of "writers relying on a 3rd party that relies on another 3rd party" business concern, etc.

I think that's enough for now. Clearly, the issues with Demand Media / Demand Studios aren't all about the rate debate. Sometimes it's just about the stupid sh*t those associated with them say and do.

I had to stop and look at that farting article. I love how it encourages you not to get carried away with farting, like recreational farting is such a major problem. “Damn, it’s nine PM! I’ve been fartin’ so much that I lost track of time!”

Well, I suppose if someone were really desperate, they could argue that it was about “improving the lives” of those around you. 😉

I have never understood why anyone would say that “You could make $22-25 an hour.” Their pay is per article. It should be presented as the per article rate. What one person makes per hour is not going to be the norm for everyone. I find it hard to come up with an hourly rate, when the articles written still have to be approved. You might have written 3 articles in one hour, but not all of them will get approved right away or at all; based on what I’ve read from other people. (correct me if I’m wrong)

I also don’t care for the way they market that opportunity. They make ‘Work from Home, Flexible Schedule, and Write about what you want’ sound like job benefits. They’re not job benefits. They’re only benefits to the people who choose to write for them. (I’ve gotten into a few scuttles over that one. )

If I see these claims on a site, such as Craigslist, I pass that ad on. It’s not just DS though. There are companies that offer customer service jobs that make some of those same claims and that drives me up the wall too.

Somewhere on their site this morning I saw a note that the average writer makes $20 per hour (so even less than the more generous estimate we gave from their other averages noted elsewhere). Then again, after citing a few specific on-site references yesterday, some seem to have vanished. So I’m not sure what that’s about — maybe general site changes or what. So who knows? Maybe that $20 stat will be gone soon too.

I see their website and some job ads are different than what I saw the last time I looked at them. They no longer scream ‘Work from Home’ opportunity that they used to. I do give them credit for that. I still don’t see any reason to be quoting possible per hour rates, though.

wow. this is obviously a well-researched and well-thought out look into DS. I am doing a quickie of morning blog posts, but I’m going to print it off and read “for real” when I have time. I think this may have to be bookmarked for all my about.com readers who ask about DS.

This is one I’ll probably end up converting into .pdf format and making it available in the freebies download section after a while. I want to keep it focused on the post now for comments’ sake, but I think that’ll give it some extra life for those looking for additional background and keep it from getting buried.

I hope you get something worthwhile out of it when you have a chance to read it “for real.” I know it’s a bit of a beast to get through, but their execs, site, and job listings did such a great job of practically writing it for me that I figured I better hit it all at once. 🙂

You’re right about my post (the one you referenced). I did couch my mini-experiment as a DS contributor exclusively in terms of the rate debate.

That’s not because I’m oblivious to other criticisms. It’s because (1) the rate question does tend to be the most discussed issue re: Demand, (2) it’s the issue that matters the most to me personally and (3) I wasn’t in the mood to bite off as much as you have here!

This is really an outstanding post. I don’t say that because I agree with you on all points (I don’t), but because it’s great to have a more comprehensive list of concerns outlined in one place and presented as more than simple statements of unsupported opinion. I also like the fact that you explained the context from which you’re making these arguments.

I’m curious. Did you contact anyone at Demand to get an explanation for some of the problems you see with their marketing, etc.?

1. Just to make sure I’m 100% clear (and I’m not saying you took it this way), but nothing in the post was about slamming your approach or reasoning. It was just the straw that broke the camel’s back as far as one too many mentions of the rate debate. 🙂

2. You’re always welcome to disagree with my views. Reasonable people often do.

3. No, I did not. They’ve been made aware of issues like these before, such as during the initial health care push. They went largely ignored. They’ve been made aware of complaints, and their response most often gravitates towards the “if you don’t like us, you just don’t understand us or know what you’re talking about” attitude. And I’ve had enough of that both from them and bloggers they sponsor who like to run to their defense.

4. I think the post already covers how valuable a quote from them really is. To be quite frank, I’m sick of the “you need to ask for their input if you want to criticize them” crap. They’ve given their input. Countless times. They’ve changed their story to suit them depending on the interview. There’s little credibility, and when one of the primary issues is in pointing that out, commentary on what they’ve already said about themselves publicly is more than enough. This will not become another platform for their PR speak. Full context of everything quoted was made available in the post for anyone wanting to do further research on their own.

5. And as I said in the very first paragraph, this is my opinion based on the facts out there. It’s not meant to be a case of first-hand reporting. That’s not my job as a blogger on this particular site.

Wow, this was pretty comprehensive, and yet I still feel the need to add something, if I may.

I gave them about a 2 month shot. The problem was once I got through the articles where I absolutely knew the content, there wasn’t much left but garbage topics. Even with that, based on your numbers, if I’d wanted to actually write 57 articles a week there were only enough topics to have lasted maybe 3 or 4 months if I was lucky. And that’s if I was the only writer. So, the claim is a ridiculous one across the board.

Whew, when I wrote my rant, I think I only hit 750 words or so. lol

I hadn’t even thought about that aspect, which is odd because I was just talking to someone about their niche topics the other day. That’s definitely another potential issue when it comes to things like the claim of a comparable rate to journalists’ salaries. It’s easy to shout about the huge number of overall requests out there. But with ones like some of the examples I cited in the post here, that isn’t necessarily saying much, especially to a writer counting on being able to write in their area of expertise for faster turnaround.

To be fair to Demand, more articles may very well come in on any topic. But to be fair to writers, they also might not. That’s a risk, especially to those writers who rely too heavily on a single client or site (any, not just Demand).

1. I took no offense whatsoever. Heck, thanks for the link 🙂 I just wanted to mention why my remarks in that post were confined to the rate question.

2. Really, my differences in opinion are less about the evidence provided and more about the conclusions drawn from them and the weight we should ascribe to them. In other words, they’re probably something close to reasonable.

You mentioned Demand-sponsored bloggers who are willing to run to DS’ defense. In the interest of full disclosure, I’ll mention that I am going to be involved with a Demand-sponsored project and I currently do receive compensation for writing posts at a site that carries DS sponsorship.

However, I steadfastly refuse to allow those affiliations to color my perspective on DS. People buy my words, not my soul.

I know you weren’t including me, specifically, in your comment. I just didn’t want some smart alec piping up and saying, “Of course, he disagrees with you JM–he’s on the payroll!”

3-5. Groovy. Just wondered. Not trying to imply that you had an obligation to do so. Clearly, you don’t.

I could’ve sworn I wrote this as a reply to your early comment. Sorry it fell out of the thread. Feel free to shove it around where it belongs!

No worries. I’m still getting used to the threaded comments myself. But I cheat and respond on the back-end when possible so it’s harder for me to screw it up. 🙂

Yeah, I’m well aware of your current affiliation at least, and thanks for mentioning that you’ll be involved with another.

I do not automatically think someone accepting sponsorship falls within that category, and I’d have no reason to believe that being paid by someone they sponsor would influence your personal opinions and posts. But that isn’t always the case, and sponsor / blogger relationships aren’t always as transparent or ethical as they should be (and of course “ethical” is subjective).

For example, here are a few things I’d personally consider unethical (and yes, I know you and others might very well disagree):

1. Someone who goes out of the way to “rally the troops” into a mob mentality attack because someone criticized the company when they’re being sponsored (actually, I’d consider that unethical sponsor or not when you take a disagreement and push others to take impersonal comments personally);

2. Claiming to want to help writers get higher paying jobs while accepting sponsorship from, and promoting, mills like Demand;

3. Disclosures that aren’t really “clear and conspicuous” (to use the FTC’s term) — meaning, if it’s not front and center or otherwise completely obvious before people read your posts, I consider that kind of disclosure to be pretty much worthless after the point (not to mention those who think a separate disclosure page or old post is enough, as though everyone’s familiar with your site beyond the page they land on from their feed reader or the SERPs).

4. Those who DO allow a sponsorship relationship to influence the editorial side in any way;

5. Releasing news from said sponsor early to build hype with your community without the full facts;

I’m sure I could come up with more than a few other examples. But I’m tired. 😉

Some bloggers might fit under several of those categories. Some might only fall under one. And yes, that’s on the blogger. But what’s on Demand (or any company involved in blog sponsorships) is choosing to stay associated with bloggers engaging in these types of things, which does little to help their reputation (other than to provide more of their misleading information — with a good example given by Yo).

We’d be silly to think that some folks won’t be improperly influenced by money. We see too many examples to the contrary to pretend otherwise. That’s why it is important to let people know where you’re coming from so that they can’t pretend as if you’re bein

Re: your list of ethical problems…

1-As described, sounds like bad news to me.

3-Disclosure is important, no disagreement from me!

4-Agreed 200%

5-I suppose that could be an issue, too. Fact-dependent, perhaps, but enough to raise the eyebrows under many circumstances.

2-This is where I think we move from questions of ethics to matters of disagreement.

If I were to say, “You can write for DS to fill gaps in your schedule while you hunt for more lucrative gigs”, I’m promoting DS *AND* the pursuit of higher-paying work. There’s no ethical tension.

You might think it’s *wrong* advice, but that’s a legitimate argument (right or wrong) not something unethical, per se.

… except that’s not quite the kind of example I was thinking of when writing that list. 😉

Instead, think more of what Yo mentioned — someone claiming to be about higher paying work, and then proceeding to push a mill sponsoring them as a full-time option to their Twitter followers, blog readers, forums they associate with, etc. So yes, there can be different shades of gray in between that I might not agree with but which aren’t an issue of ethics. But there are also cases where I’d say it clearly is.

I think my monitor may have more gray on it than yours does.

I’m going to leave it at that in terms of comment remarks on this facet of things. I don’t want a hypothetical discussion of appropriate ethics (a serious matter) to accidentally devolve into something more specific when neither of us are naming names, detailing specifics, etc.

lol Absolutely fine by me. Intentionally not naming names on this one (and if I did, I’d have to cover much more than blog sponsorship issues on the ethics front). Unfortunately the specific case I’m thinking of tends to evolve into “you’re only criticizing so-and-so for traffic” or “poor me, someone’s being mean to me” discussions, and frankly that’s a certain level of drama I have no patience for these days.

I just wanted to add something re: asking them for additional comments while I’m thinking of it:

We’ve always allowed for pretty open conversation here, and I think we have one of the most liberal comment policies around. Short of being a pathetic troll following me from site to site thinking you’re anonymous or associating me and my readers with the KKK with unfounded accusations, comments will get through. We’ve had open discussions in this way with reps of other companies over similar issues (including Odesk, who I’ll give some credit to because at the very least they did correct false ad copy on their site when we brought it to their attention). I’ve had similar exchanges with companies on other blogs I run where we’ve had similarly productive discussions. That’s always welcome, and from the history I can say I don’t turn those discussions into attacks against the individual — only the policies being discussed.

So if one of Demand’s reps ever does want to stop by here, they’re very welcome to — not only in the comments to respond to some of the issues raised, but for an interview to be published independently if they prefer. Anytime. It’s easy to be interviewed by people you’re paying (ex: interviewer with loaded question lead-ins about the bias of critics w/o acknowledging the bias of being paid while conducting said interview). But if they’re interested in answering some of the harder questions, they’re willing to leave the PR speak at home (I used to write the shit, so if they try to feed it here it’s going to be chewed up and spit right back at them), and they understand that everything they say will be fact-checked out of respect for this site’s freelance writing audience, then they’re very welcome. As much as I despise some of the corporate speak and what I consider to be very misleading marketing, that shouldn’t be construed as a personal dislike of anyone quoted here on a personal level, and wouldn’t be treated as such (anymore than you could say I “dislike” Carson because I disagree with a lot of his views — in fact, I’d say it’s quite the opposite).

You don’t hate me? That’s a plus.

🙂

Nah… I think I missed your posts too much while you were gone. So maybe still wearing the rose-colored glasses since you’re back around. And then there’s the fact that you often give me new things to talk about. 😉

I think you like having me around for the same reason I like having you around–even (if not especially) when we disagree.

It’s nice to have people around who’ll challenge your perspective, provide you with motivation to develop your arguments, etc. without getting into some kind of fight. That’s how it should always be–it’s the marketplace of ideas in action and it should be nudging us all toward the best possible conclusions.

Plus, I’m so damn funny, look like a matinee idol and am usually right about everything. That helps, too.

LOL I’ll leave that last comment alone. But I DID just see a manatee statue holding a mailbox the other night (no joke). I didn’t realize it was meant to be your likeness. 😉

My biggest complaint about DS from 2008/early 2009 (when I was writing a lot with them) until this very day was against those who claimed that a full time income with them was easy to generate. Are the articles relatively easy at a few per week? Of course they are. But when you have sponsored blogs pushing a full time income with DS on Twitter and Demand themselves making it seem like a real option, I have a big problem with that. Then, when pro-Demand folks dismiss my point of view with “elitist, old-school, jealous, biased, malcontent” comments instead of just realizing that we each have a different POV and disagree, I get really peeved. One person went so far as to start attacking me on another blog in a conversation I wasn’t even involved in–classy! Another person once accused me of being a rich elitist, which I find hysterical. As a chick who grew up at times without food and living in an Airstreamer, I don’t think I’ve grown up into some kind of rich, out-of-touch elitist. I don’t care what anyone does to support their family, and no one needs to care about what I do for mine. But if I can share a better way and cut through the B/S of those with their own agenda or allegiances (of which I have none), hell yeah I’ll do it.

My second problem with Demand was their misinformation and CONTINUED misrepresentation of their limited benefit health plan as a group health insurance policy. As a health insurance agent I saw through that immediately. I also conferred with other health agents who sell health insurance on a regular basis (I sold life insurance although I am licensed to sell health as well) and we all came to the same conclusions which I outlined in my post (which you linked to). It’s okay for DS and other content mills to exist (as far as I’m concerned), and it’s okay for people to write for them, and it’s okay for them to pay what they pay (if you don’t like it, don’t write for them–they’ll get what they pay for). What isn’t okay is the misrepresentation of their “service” to writers and their “benefits.”

“It’s okay for DS and other content mills to exist (as far as I’m concerned), and it’s okay for people to write for them, and it’s okay for them to pay what they pay (if you don’t like it, don’t write for them–they’ll get what they pay for). What isn’t okay is the misrepresentation of their ‘service’ to writers and their ‘benefits.'”

And you just summed up that monstrous post in two sentences. I hate you. lol 😉

Somehow I don’t think this post would be nearly as effective if was only a couple of sentences long!

But I’d be well-rested, and that has to count for something! lol

Jenn:

Thanks for the tremendous effort I know this took to pull all the figures-quotes, etc. together for a really comprehensive post. I have said before that I firmly believe that I cannot sit in judgment of the decisions people make – it’s their life.

That being said, I totally agree that being informed is key to the decisions they ultimately make. When I 1st started freelancing, I applied at DS and was accepted. My intent was to build a portfolio. I soon realized I had a lot more samples of my work (from 30+ years in Corporate America) than I thought I did.

For that reason, the low pay (I simply couldn’t justify that no matter how I looked at it) and what Mitch said about the lack of topics for niche (health insurance, health care, wellness-before Livestrong), I never pursued it.

Again, thanks for the great post and caring enough to take the time!

Really, “being informed” is what it comes down to. And unfortunately as much as people like to say criticisms aren’t worth much on that front b/c they assume everyone’s just personally bitter or has an agenda against the specific company, what’s sometimes neglected is that the information coming directly from Demand is often no better than even the worst case studies.

And when you get what looks like official information (like details about the health care plan) from the company, it’s a reasonable assumption for a writer considering them that the information would be accurate. When it’s NOT completely accurate, and that misleading information is presented as a way to convince writers to sign up, that’s when we have a problem. I think people are smart enough to recognize opinions and take them for what they’re worth (and that’s precisely why I made a point of giving my background here for context). But they shouldn’t have to question information officially released from the company, and they shouldn’t have to question everything coming out of their CEO’s mouth because what he says doesn’t hold up against other facts and information released by the company out there. When that kind of misinformation is out there, it makes it very difficult for even the most diligent writer to make a really well-informed decision.

Now, I see, this cockroach of the internet is going to supply “news” to two Texas newspapers. Joy. One of my big complaints is the internet goo that will eventually bring down the informational value of the internet–like plaque in an Alzheimer’s-affected brain. I have never made young Mr Rosenblatt even richer–even as an experiment–but I worry about the quality. No offense to anyone who has made the decision to work for this outfit. Are they the ones with a screen shot system or keystroke counter Big Brother? Or is that another one?

Actual “news” or just more evergreen content (like the health writer they had doing travel writing for USAToday)?

And no, the Big Brother ones are the freelance marketplaces — Elance, Odesk, and I believe RentaCoder joined the fray. Don’t worry though. They’re far from off the hook. Down the road (probably sometime this summer), we’ll be taking another look at that issue as previously promised. It’ll just be a while because I want to consult with enough tax professionals and hopefully an IRS contact or two on the implications of those tools and what they enable “clients” to get around in employee / IC rules.

Proof positive that we can find room for agreement amongst our occasional head-butting. The Big Bro. systems and the way they can be (and often are) used really bugs the hell out of me–both on a personal level and w/ respect to the legal issues involved.

With respect to Star’s concerns about the use of “goo” at a few TX newspapers… I’m sure they’ll be using the how-to and evergreen stuff that forms the core of DS’ inventory. I’m also guessing that they’ll exercise something akin to their usual editorial discretion when choosing the material.

Those of us who’ve picked up a paper lately will realize how little that might actually mean, though.

This does raise an interesting issue, though… If DS successfully sells inventory to third parties who place the content in higher-profile publications, does that $15 (admittedly sometimes more) rate still “feel” right to contributors. It’s one thing to churn out $15 work when you know it’s being used to scrape of ad earnings, etc. For some, it may be another when the stuff starts showing up in better-known pubs.

That’s always a possibility. As is the possibility that newspapers and such will eventually stop buying the content (for any number of reasons — future credibility concerns, issues with their own writers or unions they deal with, etc.). I think something often left out of the “journalism’s a-changin” discussions is that it’s not entirely an industry issue. There are also larger economic ones affecting many industries, and history tells us that will eventually hit another upswing. And when that happens, while I don’t think newspapers will ever go back to their glory days, the allure of cheap content from Demand could very well fade when they can afford to bring in more authoritative sources again. We don’t really know what people will be willing to pay for when the economy improves, and the models papers are moving towards now might not continue indefinitely (what does?).

I think your past post on the sustainability of content mills applies here as well. Is this push into newspaper companies partially their way of trying to survive if or when those changes from Google come? Would it be enough? And would it be any more sustainable?

I think we just have to wait and see on a lot of fronts. And while I don’t approve of a lot of things around Demand Media, I do have to admit I’m looking forward to the show.

Thanks for the in-depth article. I just signed DS as a site sponsor two days ago, so I look forward to future conversations. Just to be clear upfront, I do not represent DS, so any comment I make should not be interpreted as coming from them. I say this for them, not me. The last thing they would probably want is for my offbeat comments to be claimed as representing them.

As for your points in the article, most of them have merit. None of them dissuade me from thinking that DS is more good than bad, but they are certainly not above criticism. I’ve yet to encounter a company that was.

When you’re able to look at facts like that and still decide that it’s a company you’d want to associate your name and reputation with, I can’t argue with that. That’s a decision every person will make for themselves. And I’m 100% okay with that as long as they’re making that call based on the whole picture rather than marketing / PR speak, and as long as the sponsorship doesn’t cross what I would consider ethical lines as their reader (some I mentioned in my conversation with Carson above). So best of luck with your sponsorship / series. 🙂

I feel the same way. You look at what you know about a company and make up your mind about how you feel. I agree with the statement (probably Chris Brogan, maybe Seth Godin, possibly both) that your biggest critic is your biggest asset. Somebody needs to keep DS, or any company (or me), aware of their shortcomings and their perception. The conversation is important.

This exchange and the one with Carson is so normal a little pee just ran down my leg. That may sound bad, but it’s actually a good thing 😉

Thanks. Thanks for that. lol

Always happy to inspire incontinence!

I agree with that completely (which is why I find Rosenblatt’s dismissive attitude of critics just not understanding them to be so irking).

Convincing a CEO to have the same view as a blogger can be a challenge 🙂

I’d settle for a CEO telling the truth (but yes, I know that can be a stretch too). Few of the issues regarding Rosenblatt have to do with differences in “views.” They have to do with his statements of fact that were, well, let’s call them “less than facts” when you actually look at the evidence.

I was only referring to the possibility of his view on critics being similar with mine, not on having him agree with you. That would be an even bigger challenge.

OK. But you said “blogger,” which is a little different than “critics,” which definitely go beyond the blogosphere in this case. 😉 Sorry if I misunderstood your point or took it out of context in some way.

Yes. by blogger I meant me, but i understand the confusion.

I tried signing up for Demand, but never could find any topics that I could write off of the top of my head. Many of the topics were so obscure you would need serious expertise or a lot of research. I checked back a few times, but the search mechanism for topics was clunky and annoying for me to really find anything I felt was suitable for me.

On top of that, I got a couple of notes that I needed to update my profile and samples before I could grab any topics. The level of detail they wanted seemed intrusive, so I decided not to update my profile at all.

While I may still be a struggling writer, even all of that was too much for me. I’d rather work on getting my portfolio and samples in order than make $5-10/ hour writing their articles. And really, if we’re honest with ourselves, that’s probably a generous number if you look at what’s actually available in topics (no one person will be able to cover all of them) and the true amount of time it takes to write the articles. I’m referring to the average DS user, not the ones that claim to make a full-time living writing hundreds of articles a month. I have a feeling that far more are only making coffee money. If that.

That’s possible. I just don’t want to get behind any certain “average” since even they haven’t been able to do that. What I’d be interested to see eventually are the real numbers. I mean, obviously you’ll never know (or be able to prove) what all DS writers make, how many articles they have to write to make it, how long each takes on average, and how much additional time goes in beyond writing. But some level of formal survey of their writers would be better than nothing. So far the closest I’ve seen would be people sharing their stories on other writing blogs. But still little’s verifiable, and more importantly those sites tend to attract a certain type of writer that might not be representative of that “average” writer for DS. Or better yet, if the information’s not there and verifiable, might be better not to advertise those floating averages at all.

Argh – I totally forgot to mention the health “insurance” thing. It’s so frustrating with how misleading that all was. And we all know how hard it is to get good coverage (that doesn’t cost a fortune) as a freelancer. I really felt like that was preying on us as freelancers when that first came out. Of course, that’s just how *I* saw it. Others’ mileage may vary.

Wow Jenn! Appreciate the exhaustive look at what Demand is or isn’t. I’m definitely one of those focused on the rates, but this context is all interesting to know as well.

Carson makes an awesome point (did I say that?) — how long WILL $15 be the rate if work starts appearing in major newspapers? Will writers really put up with that? Let’s hope not! Same for AC writers and appearing on Yahoo, hopefully.

Yo — thanks for my laugh of the day. I think a little pee ran down my leg as well now!

You oughtta be saying that more often, you know.

The part about me making awesome points.

Not the part about incontinence.

🙂

Personally, I think freelance writer incontinence is not something we should continue to sweep under the rug. It’s a growing concern.

Carson does make the occasional sensible point–WHEN HE DOESN’T RUIN IT WITH HIS SARCASM ;-P

I was going to make a remark about soggy rugs, but I was afraid that a bad joke might be interpreted as another character flaw.

I suppose it’s better that people think I’m sarcastic than to believe me an egomaniac.

Even if I am both.

You say that as if there is something wrong with being a sarcastic egomaniac who pees on the rug….

Good point, Rebecca.

I’m not able to respond under your comment.

We have apparently reached the limits of threading.

And to think, that happened on the part about pissing, sarcasm and ego.

Oh wait, it worked!

But we are up against the edge. There’s no “reply” button on your comment.

Well, when you make more awesome points, Carson, I will be happy to point them out. This is me not holding my breath….

I don’t know you well enough to laugh or to be offended, Carol.

Well, I laughed, but that’s just me. 😉

Yeah, but you’re not the one who (ahem) doesn’t make good points.

Then again, she said she’s holding her breath until I do… And I don’t think she’s suicidal.

So maybe I’m not *that* bad.

Hey Jenn,

Thoughtful research. I appreciate the time and effort you put into this post. I do, however, disagree with some of your characterizations. I started typing a response, realized it was kind of an obnoxiously long one to clog up a comment thread with, and instead posted it on my blog, linking back to your article.

Thanks for your thoughts Lauren. But here’s how I see it.

Re: Journalism

1. It doesn’t matter if there are different types of journalism. Rosenblatt did not make that distinction. He said no one called them journalists but journalists. That was flat out false — not just an opinion on my end.

2. It might BE smart business to hire journalists. Nowhere did I disagree with that concept. But lying about intent and targeting as a way of discrediting critics was the issue — not the fact that they were actually targeting journalists. Had they been open about that and acknowledged the criticism fairly, it would have been a very different story. While I focused on one of the most clear-cut quotes from Rosenblatt, there were others. If you search other blogs, you’ll find his claims about targeting journalism have already been discussed for quite a while in comparison with their actual advertising approach.

Re: DS as a full-time option

1. Also, I nowhere judged the writers who choose to use DS full-time, as your post implied. Nowhere. I didn’t say it could not be used as a full-time job. In fact, I stated otherwise (whether it’s a “good” full-time job imo or not is irrelevant). But when DS and their representatives try to counteract critics by making claims that THEY do not intend to create full-time jobs, and then they market it as a viable full-time opportunity, that’s a half-truth as best. And again, my issue is with the honesty and accuracy of what they say in order to market the site to new writers and attempt to diminish the effect of criticism by dismissing it with blanket claims like that.

2. As for the interview quote, I agree that one is more subjective (as was discussed with Carson Brackney above — some of my thoughts here will be, which is precisely why I covered by own biases and intent before getting into the facts of some of these issues). As far as I’m concerned, you can’t on one hand promote it as a great freelance option and on the other hand try to make it sound comparable to a full-time job (and they did not solely do that with the interview comment — it was that in combination with other things, like making the health insurance sound like a “benefit” in some instances, which really pushed that comment to cross a line with me). It was taken in context with other remarks from the company, rather than forming my decision on its own.

Re: Health Insurance

1. It does not matter if the “health insurance” is more than some can get on their own. That’s irrelevant to the particular point I was making about their claims. It also doesn’t really matter if they tell people to read the terms when the information they’re personally releasing with a direct intent of getting people to sign up isn’t fully accurate (and normally I try not to assign motives, but let’s be frank here — when you heavily promote something as a benefit of working for you, doing so to get people to sign up and write 90 cheap articles for you, that’s a pretty clear-cut marketing effort to get people to join DS). Posting information that contradicts yourself isn’t coverage against the misleading info you’ve already posted. They might refer to them as limited medical plans in that particular place. But until they stop referring to it as though it’s normal group health insurance (which they’ve done in JournalismJobs.com ads directly for recruiting for example), it’s no defense. Even their own literature can’t seem to make up its mind about whether it’s what most people consider “insurance” or a limited discount-style plan.

2. I completely agree that it’s the writers’ responsibility to read the terms. However, my argument was much less about them knowing what they’re ultimately getting, and instead the fact that it’s marketed it a blatant way to suck in more creative talent. Those writers have no reason to read the full terms of the health care plan information until after they become eligible, already cranking out 90 articles for the company. And as I mentioned in another post a while back, there are studies that already prove most people don’t read fine print. That’s why companies continue to use it. Is that an excuse on the writers’ behalf? Absolutely not. But there’s even less of an excuse for Demand to take advantage of that by posting blatantly misleading information about that plan to get writers’ attention in the first place (on their site, in job ads, etc. — that’s what writers see first).

Re: SEO versus Quality

1. When you tell writers they may not use credible sources (which add value to the reader) primarily because they’re your competition, that is indeed what I’d call dismissive of quality in the pursuit of search engine rankings. You can use SEO techniques effectively without refusing to cite credible sources that could add real value. Unless that real value for the reader is the priority, that’s not an emphasis on quality. But of course, that’s also open to interpretation, and I respect your right to disagree.

2. Just for the record, the SEO post on this blog that you referenced was a bit of satire written by one of our humor writers — not a serious post on SEO. 😉

3. I agree with you 100% that “SEO is not a crime.” Nowhere did I say that it was. I’ve worked for SEO firms. I know it can be done well, and I know it can be done with the emphasis on quality — after all, quality material is the best thing you can do for SEO as it attracts natural backlinks (one of the biggest factors in SERP rankings).

4. I think there’s a big difference between the two. WebMD is a long-time recognized authority source. Demand even seems to acknowledge that fact in that they do NOT ban it as a source for eHow.com articles. WebMD also is not the only example of a credible source blacklisted. It’s just one example that stood out. But I think I already addressed the other comments in #1 above, so I’ll leave the blacklist issue alone beyond that.

Re: Too Much of the Same Content

1. I agree. Multiple perspectives can indeed be a good thing. But that’s not so much what we’re talking about here. We’re talking about blatant “spinning” of phrases to specifically target keyword phrases — not necessarily to provide new perspectives or information. And for the company to claim they’re about saving people time, giving them 6+ articles on the same topic is much tougher to justify when you could provide those different tactics in a single larger article to truly offer convenient information to readers. I don’t care that they have multiple articles on the same topic. My point was entirely about the fact that they do that while making other claims contrary to what they’re actually doing.

2. You’re absolutely right. This blog does include different perspectives on the same issues. This also isn’t a general how-to site, I don’t make any claims about AFW being around as a big time-saver, and perspectives on issues can actually change as the facts change (not sure you can say the same about tips on training dogs). We also don’t have a primary profit motive, and as you can see, ads are pretty minimal. Heck, if you see ads at the top of the articles, those even disappear after 5 pageviews or so). While there’s nothing wrong with profiting from a site (I earn quite a bit from my own various sites and blogs too, so I can respect that as a business owner), that was never the issue in question.

3. I wouldn’t say it’s so clear the articles have to be reputably referenced. That’s why I gave the sex article as an example. There were somewhat ludicrous claims that were not in any way attributed to credible sources, and that information clearly wasn’t caught by what DS claims are reputable factcheckers in their supposedly great and strict editorial process.

4. Hold on now. How can you say “Some of this content is merely usurping the ranks of companies selling a service- putting information before advertising. No problem there?” That’s just not true. First of all, they’re putting out quite a bit of advertising. If you want to make that claim, fine. But make it for a nonprofit. You can’t talk about how fine it is for them to justify profit and then put down others’ ability to do the same selling a product (which might indeed be exactly what people want when they search).

Re: Conflicts of Interest

1. Nowhere did I say that the conflict of interest re: sponsorships was on them. I said the opposite.

2. Not sure promotion is a direct disqualification for “quality.” And if it is, I’d say you’d have to apply that to everything put out by DS writers. After all, the entire purpose (as admitted in interviews by Rosenblatt) is to write for what the advertisers want to spend money on — compensated promotion rather than self-promotion, but promotion nonetheless.

Re: Improving people’s lives.

1. Well, I’m glad someone finds the farting article useful. 😉

2. The link to the drug-test article is in the post. But best bet is to tell them to search their site. That’s far from the only one (that one was just featured because it was specifically from a DS writer, but there are plenty of others, including “member” articles on ehow — which they own, so which is equally bad for the end reader).

3. As for the lingerie one, it very clearly is about getting pregnant. In fact, the opening paragraph clearly states it’s about bettering your odds for getting pregnant. It’s not an article about how to have more sex. And really, if you have to say “turn on your partner so you can have sex,” I’d have to ask where adding the useful information really is. I think trying to defend that one while talking about credible sourcing is a bit of a stretch.

4. Supply and demand are great things. No argument from me there. Then again, in many cases there was nothing wrong with the existing supply, and DS articles aren’t an improvement.

Re: Salary Concerns

1. The ability to set your own schedule is not a tradeoff for taking essentially entry-level pay. It’s 100% unnecessary in the freelance writing world, so using it as a justification for DS is a stretch at best (just my opinion).

2. I’m honestly happy that you’re happy with what you’re making. And I’d be interested to here what you think about the sustainability when you’ve been at it for a longer period, so I hope you’ll come back and share your thoughts again on that issue. 22 minutes is great for you. It makes you one of the exceptions to the rule. I don’t deny they exist, but that’s why I also stated clearly that the comments were in reference to what they claim is average; not the exceptions.

3. Business expenses are not another tradeoff. Rosenblatt made a very direct comparison in an attempt to paint a rosier image of Demand. Without accounting for those things, there IS no direct comparison. Whether or not writers are okay with that is beside the point. They can choose to essentially work for less, and I don’t care. That’s completely their choice. But that’s not what the comments were about. Also, claiming those expenses are “already a part of their budget” does not mean they can be ignored. Again, we’re talking about a comparison here, not how an individual chooses to lay out their expenses or budgeting.

4. Nowhere did I say people didn’t take on other work. But how does it matter if they’re working full-time for DS and then still having to take on other freelance work part-time as you mention? That’s not a good thing any way you cut it as far as salary concerns. If anything, it backs up the criticism of not enough pay for the amount of time put in.

It’s easy to talk about DS as “reliable pay on your terms.” But unless a writer can honestly say they wouldn’t be much happier earning more with less hours required (which is doable in many cases), it’s not really much of an argument. For those who ARE very happy with what they’re earning, who aren’t looking to increase that, and who are content with the hours they work for Demand, I wish them nothing but the best in continuing.

As for the rest of your responses here, I haven’t read them yet, but will be happy to try to do so and respond later on. Right now though I’m starting a night of work so I can start my weekend early, and I don’t want to get caught up in an all-night discussion (which I’ve been known to do). 🙂

I hear ya. Really, it’s been a good dialog, which I appreciate. I don’t think we’re going to change each other’s minds on the subject, but I hope we’ve at least fostered more understanding. Have a great Memorial Day weekend!

RE: Journalism

1. It’s not false when taken in the context of the conversation. Rosenblatt was responding to allegations that the writers on DS are supposed to be on par with the journalistic styles of those in forms of traditional journalism.

2. Rosenblatt’s 2010 DS Manifesto stirred up a good amount of buzz, and referencing the publication, he states, ““We are so different from traditional journalism, which I have nothing but admiration for, so it was time to make people understand that.” This only lends credence to my first response. Your argument, however, is non-responsive to the fact that, given this context, the solicitation of services from those with a journalism background stands on solid ethical and business ground. They look for people with that experience; they don’t tell them it will be the same experience there.

RE: Demand as a full-time option